Working From Home – All You Need To Know To Claim Your Maximum Deduction

Coronavirus has forced a lot of workers whom either never worked from home or only did a few hours of work from home to now be working full time at home. This does mean increased costs to employees and business owners as a consequence of working from home. Here’s what you need to know to maximise your tax deduction, we will split it up as it applies to employees and business owners.

Employees

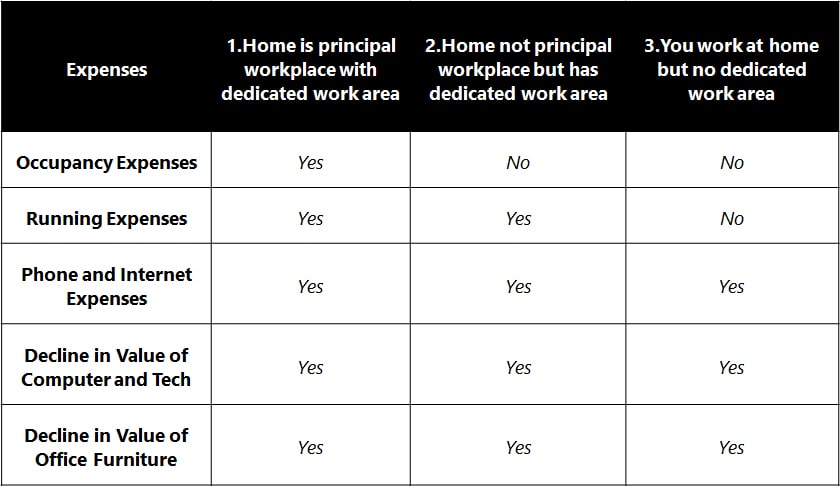

You may be able to claim Running expenses, Occupancy expenses, Phone and internet expenses, Decline in Value of Computer and Tech Items and Decline in Value of Office Furniture.

There are three ways to determine which of these expenses you can claim:

1. Home is your principal place of work and you have a dedicated work area that is unlikely to be suitable for domestic use.

2. Home is not your principal place of work but you have a dedicated work area – for example a study.

3. You work at home but you don’t have a dedicated work area – for example, you use a room with a dual purpose such as a lounge room.

The Table below summarises what expenses you may be able to claim for each of the three situations mentioned above.

Running expenses

If you work from home, you can claim the work-related proportion of your running expenses. These include:

· heating, cooling, and lighting

· the costs of repairs to your home office equipment, furniture and furnishings

· cleaning costs

· other running expenses including computer consumables (for example, printer paper and ink) and stationery.

· Only the additional running expenses you incur as a result of working from home are deductible

Calculating running expenses

There are two ways to calculate your running expenses:

1. you can claim a fixed rate of 52 cents per hour

2. you can calculate your actual expenses.

1. Fixed rate

You can claim a deduction of 52 cents for each hour you work from home instead of recording all of your actual expenses for heating, cooling, lighting, cleaning and the decline in value of furniture.

This rate is based on average energy costs and the value of common furniture items used in home business areas.

To claim using this method, keep records of either:

– your actual hours spent working at home for the year

– a diary for a representative four-week period to show your usual pattern of working at home.

You can then apply the four-week representative period across the remainder of the year to determine your full deduction amount. However, if your work pattern changes you will need to create a new record.

You need to separately work out all other home work area expenses, such as phone and internet expenses, computer consumables and stationery, decline in value on computers or other equipment.

NOTE: The ATO has announcement a new shortcut method for those who are only working at home due to the coronavirus. Check out our blog article about it here: https://cocomoadvisory.com.au/working-from-home-all-you-need-to-know-to-claim-your-maximum-deduction/

2. Actual expenses

If you have a dedicated work area, you can claim additional running costs and the decline in value of office furniture used in the area for work purposes.

To calculate actual expenses for your dedicated work area, you can:

– keep a record of the number of actual hours you work from home during the income year

– keep a diary for a representative four-week period to show your usual pattern of working at home

– work out the decline in value of depreciating assets and

o keep receipts showing the amount you spent on the assets

o work out the percentage of the year you used those depreciating assets exclusively for work you can claim a deduction for the proportion of the decline in value that reflects your work-related use of the depreciating assets

– work out the cost of your cleaning expenses by adding together your receipts and multiply it by the floor area of your dedicated work area (floor area of the dedicated work area divided by the whole area of the house as a percentage) – your claim should be apportioned for any

o private use of your home office

o use of the home office by other family members

– work out the cost of your heating, cooling and lighting by working out the following

o the cost per unit of power used – refer to your utility bill for this information

o the average units used per hour – this is the power consumption per kilowatt hour for each appliance, equipment or light used

o the total annual hours used for work-related purposes – refer to your record of hours worked or your diary for this information.

You must also take into account if any other members of your household use the home office and, if so, apportion your expenses accordingly.

If you don’t have a dedicated work area, you should work out the actual cost of your heating, cooling and electricity expenses. You can do this by working out the cost of running each unit you used per hour and multiplying that by the hours you worked from home. The amount of the additional expense is generally small, especially if there are other people using the area at the same time you are working. In those circumstances, there is no additional cost for lighting, heating or cooling.

Decline in Value

home office equipment including computers, printers, telephones and furniture and furnishings. You can claim the

– full cost for items up to $300

– decline in value for items over $300

To claim a deduction for an asset that cost $300 or more, you need to calculate the decline in value for both the period you:

– owned the assets during the income year

– used the assets for work-related purposes.

You can use the depreciation and capital allowances tool to calculate your deduction for the decline in value of equipment, furniture and furnishings that cost more than $300, use the depreciation and capital allowances tool to work this out.

Occupancy expenses

Employees are generally not able to claim occupancy expenses. Occupancy expenses include:

– Rent

– mortgage interest

– property insurance

– land taxes

– rates.

You can only claim the work-related proportion of your occupancy expenses in two very limited circumstances where:

– the space in the home is a place of business, and not suitable for domestic use – for example, a doctor or dentist surgery or a hairdresser studio in the home

– no other work location is provided to an employee by an employer and the employee is required to dedicate part of their home to their employer’s business as an office – you can claim the portion of these costs that relate to a clearly identified place of business.

If you claim occupancy expenses, you don’t qualify for the capital gains tax (CGT) main residence exemption for the part of your home that you use for work. If you use your home as a place of business there may be CGT implications when you sell it.

Calculating occupancy expenses

If you are eligible to claim occupancy expenses, you can work them out by calculating the:

Total expenses × floor area × percentage of year that part of your home was used exclusively for work

If the area you use for work takes up 15% of your home and you used it for work for the whole of the year, you can claim 15% of your occupancy expenses.

Phone and internet expenses

You can claim a deduction for the work-related proportion of your phone and internet expenses. You must have paid for these costs and have records to support your claims.

There are two ways to calculate your phone and internet expenses:

1. you can claim up to $50 with limited documents

2. you can calculate your actual expenses.

You need to keep records for a four-week representative period in each income year to claim a deduction of more than $50. These records include phone and internet bills.

1. Claim up to $50

If your work use is incidental and you are not claiming a deduction of more than $50 in total, you may make a claim based on the following, without having to analyse your bills. The rates you can use to work out the cost for your work calls are:

– 25 cents for calls made from your landline

– 75 cents for calls made from your mobile

– 10 cents for text messages sent from your mobile.

2. Actual expenses

If you have a phone or internet plan where you received an itemised bill, you need to determine your percentage of work use over a four-week representative period. You can then apply this to the full year.

You need to work out the percentage using a reasonable basis. This could include:

– the number of work calls made as a percentage of total calls

– the amount of time spent on work calls as a percentage of your total calls

– the time you spent, or data used for work purposes compared to your private usage and that of all members of your household.

If you have a bundled plan, you need to:

– apportion the cost of the plan between the services provided

– identify your work use for each service over a four-week representative period during the income year, which can then be applied to the whole year.

The same method should be used for non-itemised plans.

Records you must keep

If you’re an employee who works from home, you must keep records such as:

– diary entries for a representative four-week period to show your usual pattern of working at home that show

you worked from home and made work-related phone calls

how you work out how much you used your equipment, home office and phone for work purposes over a representative four-week period

– receipts or other written evidence, including for depreciating assets you have purchased

– diary entries to record your small expenses ($10 or less) totalling no more than $200, or expenses for which you can’t get any kind of evidence

– itemised phone and internet accounts (paper or electronic) from where you can identify work-related calls and internet use, or other written records, such as diary entries if you don’t get an itemised bill.

If you use the four-week representative period to calculate your usage over the income year and your usual pattern of work changes, you will need to keep separate records to show your usage.

For example, if you usually work from home one day a week and due to an emergency situation such as COVID-19, bush fire or drought you’re required to work from home for an extended period, you will need to keep records for both:

– the actual hours you’ve worked from home due to the emergency situation

– your usual working from home arrangements.

Your four-week representative period will no longer be valid in these circumstances.

Business Owners

Running your business from home

The information in this section applies where your home is also your principal place of business – that is, you run your business from home, and a room is set aside exclusively for business activities. Examples include:

– a small business operator whose main office is in their home

– a tradesperson or craftsperson who has their workshop at home

– a doctor or dentist who has their surgery or consulting room at home.

If you do only some business or work from home, in either a designated work area or another part of your home, refer instead to Working from home.

Deductions you can claim

Where your home is also your place of business, you can claim deductions if you carry out income-producing work at home and incur expenses in using your home for that purpose.

You can claim a deduction for the following:

– the cost of using a room’s utilities, such as gas and electricity – which must be apportioned between business and private use, based on actual usage

– business phone costs – if a telephone is used exclusively for business, you can claim for the rental and calls, but not the installation costs. If the telephone is used for both business and private calls, you can claim a deduction for business calls

– decline in value (depreciation) of office plant and equipment, such as desks, chairs, computers. If equipment such as a computer is also used for non-business purposes, your claim must be apportioned between business and private use

– decline in value (depreciation) of curtains, carpets and light fittings

– occupancy expenses (such as rent, mortgage interest, insurance, rates). You can claim the portion of these costs that relates to the room or workshop you use as a place of business. A common method of working out how much to claim is the floor area (as a proportion of the floor area in your whole home).

If your employer has an office in the city or town where you live, your home office will not be a place of business, even if your work requires you to work outside normal business hours.

If your income includes personal services income (PSI), you may not be able to claim a deduction for occupancy expenses.

Capital gains and the main residence exemption

Generally, you can ignore a capital gain or loss you make when you sell your home or main residence (under the main residence exemption).

However, you don’t get the full main residence exemption if your home is your principal place of business, although you’re probably entitled to a partial exemption.

To work out the capital gain that is not exempt, you need to take into account a number of factors including:

– proportion of the floor area of your home that is set aside to produce income

– period you use it for this purpose

– whether you’re eligible for the ‘absence’ rule (see Treating a dwelling as your main residence after you move out)

– whether it was first used to produce income after 20 August 1996.

If you first used your home as your place of business after 20 August 1996, the period before you first used your home to produce income is not taken into account in working out the amount of any capital gain or capital loss. Instead, you use the market value of your home at the time you first used it to produce income.

It’s a good idea to get a valuation of your home at the time you first use it as your place of business, so that when you come to sell it you don’t pay more capital gains tax than necessary.

Sources: www.ato.gov.au